Excitement About Estate Planning Attorney

Excitement About Estate Planning Attorney

Blog Article

Estate Planning Attorney Fundamentals Explained

Table of ContentsGetting The Estate Planning Attorney To WorkEstate Planning Attorney - Questions3 Easy Facts About Estate Planning Attorney DescribedThe 6-Minute Rule for Estate Planning Attorney

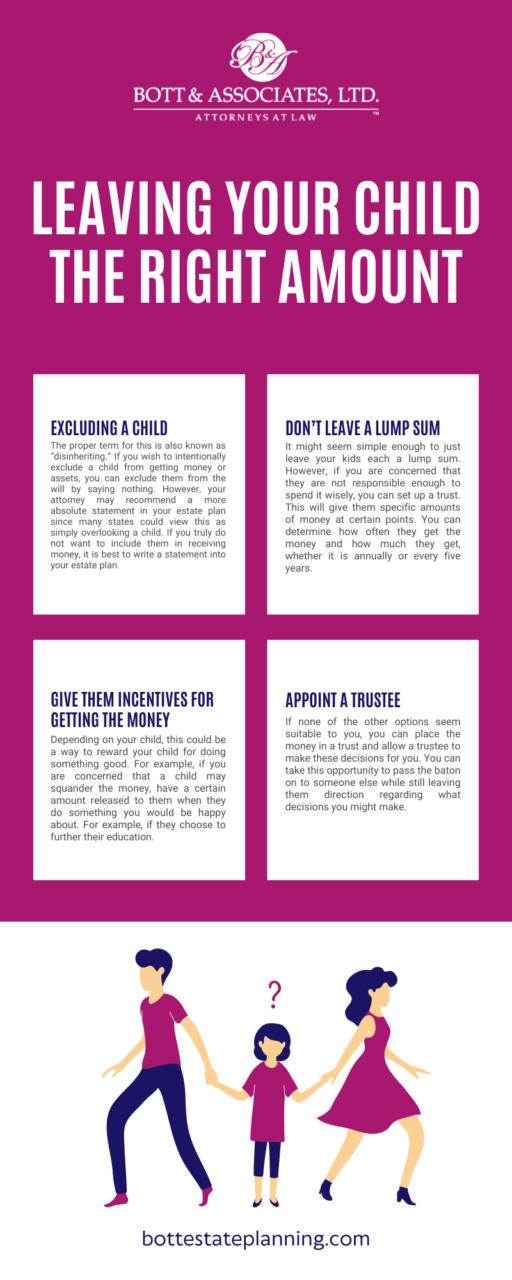

Estate preparation is an activity plan you can use to identify what occurs to your properties and commitments while you live and after you die. A will, on the other hand, is a legal document that describes exactly how properties are dispersed, that looks after kids and pet dogs, and any kind of various other wishes after you die.

Insurance claims that are denied by the executor can be taken to court where a probate judge will have the final say as to whether or not the case is legitimate.

How Estate Planning Attorney can Save You Time, Stress, and Money.

After the supply of the estate has actually been taken, the worth of possessions determined, and tax obligations and financial obligation settled, the executor will certainly after that look for permission from the court to distribute whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will certainly come due within 9 months of the day of death.

Each specific areas their possessions in the depend on and names somebody other than their spouse as the recipient., to sustain grandchildrens' education and learning.

Our Estate Planning Attorney PDFs

Estate organizers can collaborate with the benefactor in order to decrease gross income as a result of those contributions or formulate techniques that maximize the impact of those contributions. This is another approach that can be used to restrict death tax obligations. It entails a private locking in the existing worth, and hence tax obligation, of their building, while attributing the value of future growth of that resources to one more individual. This technique involves freezing the worth of a property at its value on the day of transfer. As necessary, the quantity of prospective resources gain at fatality is likewise frozen, permitting the estate planner to approximate their potential tax obligation obligation upon death and better strategy for the settlement of income taxes.

If sufficient read the full info here insurance coverage earnings are readily available and the policies are correctly structured, any kind of revenue tax obligation on the regarded dispositions of properties adhering to the fatality of an individual can be paid without turning to the sale of properties. Earnings from life insurance policy that are gotten by the beneficiaries upon the fatality of the insured are normally income tax-free.

There are specific papers you'll require as component of the estate preparation procedure. Some of the most typical ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate preparation is only click now for high-net-worth Get the facts individuals. Estate intending makes it much easier for individuals to determine their dreams prior to and after they die.

Getting My Estate Planning Attorney To Work

You must start preparing for your estate as quickly as you have any measurable property base. It's an ongoing process: as life proceeds, your estate strategy ought to move to match your situations, in line with your brand-new objectives.

Estate preparation is often taken a device for the affluent. However that isn't the situation. It can be a valuable way for you to deal with your possessions and responsibilities before and after you die. Estate planning is likewise a great way for you to set out strategies for the treatment of your small youngsters and pets and to outline your long for your funeral service and preferred charities.

Applications should be. Qualified applicants who pass the test will be officially certified in August. If you're qualified to rest for the exam from a previous application, you might submit the short application. According to the policies, no certification shall last for a duration much longer than 5 years. Discover out when your recertification application schedules.

Report this page